An Insight into the Drivers of Business Performance.

Sean has worked with Locus Research both as a client and a collaborator. We have always appreciated his crystalline advice and thinking from a business perspective. So we asked him to write about it. Hope you enjoy.

The question, in various forms, that troubles the owners of most New Zealand businesses every day: What drives business performance?

Who hasn’t considered how to make more money, reduce debt, or beat the competitor down the road? For most business owners the issue is always in the back of the mind, yet few ever sit down and work out the answer in a systematic fashion.

This is for several reasons:

My argument is that if business owners can be helped to understand their financial information at least as well as their accountant they will suddenly see a whole new range of options open up to make their business work better.

Successful corporates have understood this idea for a long time, which is why many CEOs come from a finance or engineering background. People with a numbers background may not be able to grow a business, but they will frequently be very good at getting the best out of the existing operations. Fortunately the underlying concepts are accessible to most business owners and mastery of the finer detail is not only unnecessary but a hindrance for the majority of privately owned businesses.

Where to start?

The place to start is defining performance. For most people, at the most basic level, this means making more money. However, it’s quite hard to get your teeth into that and it is necessary to be more precise.

Putting it more precisely, financial performance is, in the short term, cash flow; in the long term it’s return on capital.

Cash-flow is about survival. It’s like oxygen to a person or fuel to a car; if you run out everything stops. This is a very simple idea and cash-flow is easily monitored on a daily basis. Surprisingly, this is frequently neglected and many businesses fail to reach their potential as a result. It is more complex, but equally essential, to forecast cash-flow forwards for a 12 month period. This will highlight any icebergs looming in the distance that can be avoided provided they are seen. Failing to see them will result in business failure and is the root cause of a significant percentage of liquidations.

Not monitoring cash-flow daily or reforecasting monthly is like driving your car without looking out the windscreen. It is crucial that business owners either prepare this information themselves or have their accountant do it and explain it in a manner that gels with the day to day reality of how the business operates.

Continuing with the car analogy and assuming that the matter of not crashing into things is dealt with, we can now address the issue of improving return on capital – going faster. Return on capital drives wealth over the long term. If most people really think about it, that is what they mean by business performance or success. That’s what results in the big yacht and an early retirement.

Earning a greater return on capital than others is how Warren Buffett has accumulated a vast fortune. Slowly, over a long period, he has built his wealth because he has done better than everybody else has. The first crucial point to grasp is that it is not the absolute return that matters – it’s the difference between your return and everybody else’s.

In the case of most businesses, the key is in the difference between the return your business generates and the return you could have gotten by putting the money in the bank. If the bank is paying 5% on deposits and your business is giving you 15% then you are in the money and you should keep going. If the business is giving you less than you could get from the bank, you need to fix it or sell it.

Many business owners do not know the return they are getting on their capital and are therefore a long way from addressing the issue of whether they should keep going, invest more and try to grow, make some changes, shut it down, or sell. These are quite important questions and the answers can be worked out in a systematic fashion.

In the event that a business owner is monitoring cash-flow daily, reforecasting cash-flow monthly, and has a firm handle on the return he or she is earning on capital, it is then appropriate to consider how to make the boat go faster. It’s pretty common to try to make the boat go faster without understanding the numbers first, but that is like swinging on winches and pushing buttons without knowing how they are currently set or how much leverage they have. The boat will move but it won’t reach its potential.

Return on capital at its most basic level is a function of the amount of cash a business generates in a year and the amount of cash invested in it. Sticking with the simple terminology, we’re talking about sales, margins, and overheads on one hand, and stock, debtors, creditors, and fixed assets on the other. These are the big numbers and that is generally where attention should be focused in the first instance – that’s called leverage.

A numerate business owner looking for better performance will always work on the point of highest leverage first. Frequently one or two changes in high leverage areas will shift a business from wealth destruction (earning a lower return than you could get from the bank) to wealth creation.

For example, gross margin is always a fertile area to mine for performance improvement. A 1% improvement here with no other changes will usually be unnoticed by customers and will drop straight through to the bottom line. Getting your hands on the 1% improvement can often be achieved through either subtle changes to list prices or investing time and effort in training sales or customer service people to reduce adhoc discounting.

A business with annual sales of $5 million at 40% gross margin should seriously consider investing $10k on incentives or staff training to reduce discounting. A margin increase of 0.02% would pay for the training and anything more is cream for the owner – this is a calculated risk which is highly likely to pay off and only becomes apparent once the drivers of financial performance are well understood.

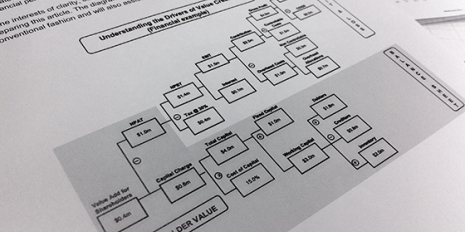

In the interests of clarity, several accounting concepts have been butchered in the course of preparing this article. The diagram below sets out the concepts discussed in a more conventional fashion and will also assist in understanding how they fit together.

Comments

Post new comment