Business R&D Budget Boost.

The government has announced a $225 million increase in R&D spending that is targeted at the business community, although primarily at medium to large 'research intensive' enterprises. Which on the surface appears to be good news.

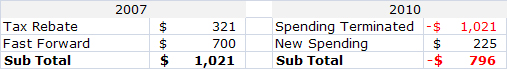

In evaluating whether this is going to make a material difference, it is worth stepping back and taking a look at the changes to RS&T funding over the last few years. The current government has eliminated an estimated $1021 million in RS&T funding since achieving office, resulting in a nett loss of $796 Million over a period of 4-5 years (after the current addition is substracted off). The tax rebate is estimated based on the government valuation of R&D spending in 2008 and it does not include industry contributions.

Whilst John Key has increased the flexibility of the use of funds, it is still clearly requires a consultation and approval process which will be administered and excludes a number of start up companies as it is limited to medium to large enterprises. The spreading of the marmite over 4 years also makes making sense of the actual figures difficult, it would be easier to clarify the annual expenditure and break it down by who it is given to.

The issue of centralised management of R&D funds will always be 'who picks the winners', a difficult job no matter who you are. There are many success stories which are not in hot-right-now industries, and early adopters can run ahead of the pack.

An R&D tax rebate incentivises and does not discriminate on the nature of someones business, as it is retrospective, the funds spent are likely to ensure the company is committed as it affects their cashflow. New Zealand commits 1.16% of GDP to R&D, compared to Australia 2.10% and OECD average of 2.26%. Australia has an estabished Tax rebate scheme and has a 1% higher level of commitment to R&D than New Zealand.

Their is always the risk that there will be some mis-use, but it is outweighed by the direct action of the rebate. It encourages and enables companies to commit more to R&D without consulting or getting approval, a bit like GST.

The other critical issue is how 'Innovation' is treated? in the context of this work it is probably not adequately dealt with or covered. The government report on innovation mentioned in a previous post outlines what innovation is, a description which falls well outside R&D expenditure. If you talk to most experienced scientists or business people, New Zealand does not suffer from a shortage of good ideas or science, but rather execution or innovation.

The distance between the Government funding mechanisms for R&D and NZTE are vast, and this is the space where innovation operates, and it is an area which is often mis-understood and recieves little in the way of formal government agency support.

In summary, there are some positives, and aligned with other changes in the technology funding system like the joining of MRST and FRST and the Re-Combination of CRI's it may be more structural that what it appears, but it is hard to agree with Key's Science Adviser, Sir Peter Gluckman, who described the announcements as "the most significant for New Zealand science in 50 years" when you take a look at the net reduction in dollar terms.

Food for thought.

Comments

Post new comment